GST Billing Software

Unlock Efficiency with GST Billing Software

In today’s fast-paced business world, staying compliant with tax regulations while ensuring operational efficiency is more important than ever. GST (Goods and Services Tax) is a key part of the Indian tax structure, and businesses of all sizes need effective tools to manage their tax-related tasks. This is where GST billing software comes into play. Not only does it streamline tax filing, but it also enhances your overall business operations by automating several key processes. Let’s explore how GST billing software can help your business unlock greater efficiency.

1. Simplifying Tax Compliance

One of the biggest challenges businesses face is ensuring timely and accurate GST compliance. The GST regime requires businesses to regularly file returns, maintain detailed records of transactions, and generate GST-compliant invoices. Manually managing all of this can be time-consuming and prone to errors, which could lead to penalties.

GST billing software simplifies this process by automating many of these tasks. The software ensures that your invoices are GST-compliant by automatically applying the correct tax rates and generating invoices that meet regulatory requirements. It also helps in generating GST returns quickly, eliminating the need for manual calculations and ensuring that your business stays on top of tax deadlines.

By automating tax compliance, GST billing software helps you save time and avoid mistakes, allowing you to focus on other aspects of your business.

2. Automating Invoice Management

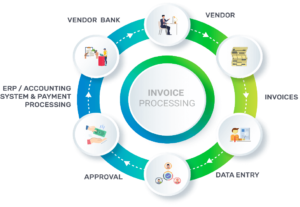

Managing invoices manually can be cumbersome, especially for businesses with high transaction volumes. GST billing software automates the entire invoice generation process, from creating GST-compliant invoices to tracking payments and maintaining a digital record of each transaction.

With GST billing software, businesses can easily generate invoices by entering the necessary details like customer information, product or service details, and tax rates. The software then automatically calculates the GST and applies it to the invoice, saving you the trouble of manual tax calculation.

Moreover, the software maintains a record of all invoices, making it easy to access past transactions, track payment statuses, and send reminders for overdue payments. This level of automation significantly reduces the time spent on manual invoicing and helps avoid errors related to missed entries or incorrect calculations.

3. Reducing Human Errors

Manual processes are prone to human errors, and tax filing is no exception. Incorrect data entry, miscalculation of tax, or forgetting to submit returns on time can lead to costly mistakes, audits, and even penalties from the tax authorities.

GST billing software reduces the risk of errors by automating tax calculations and return filings. It uses pre-set tax rules and rates, ensuring that all transactions are processed correctly. In addition, the software automatically generates accurate reports, minimizing the chances of mistakes in your financial statements and making it easier to meet compliance requirements.

This improved accuracy not only helps you stay compliant but also boosts the credibility of your business with clients, partners, and tax authorities.

4. Real-Time Reporting and Analytics

With GST billing software, businesses gain access to real-time reports and analytics, which are crucial for decision-making. The software provides a clear overview of your sales, taxes, and overall business performance, helping you stay on top of your financials.

For instance, you can easily track the GST collected on sales and the GST paid on purchases, making it easier to reconcile input and output taxes. The software can also generate reports on outstanding payments, taxes due, and upcoming filing deadlines, ensuring that you never miss an important task.

Real-time reporting allows you to monitor cash flow, detect discrepancies, and make informed decisions faster. It also streamlines your auditing process, saving you valuable time when preparing for financial audits.

5. Enhancing Productivity

By automating time-consuming tasks like invoicing, tax calculations, and reporting, GST billing software frees up valuable time for your team to focus on more strategic activities. Your staff no longer needs to spend hours managing paperwork or double-checking tax calculations, which improves overall productivity.

With all the data in one centralized system, your team can work more efficiently, access information instantly, and collaborate seamlessly. This boost in productivity translates into cost savings, reduced operational overheads, and a more agile business.

6. Scalability for Growing Businesses

As your business grows, managing taxes and invoicing manually becomes increasingly difficult. GST billing software is scalable, meaning it can grow with your business. Whether you‘re expanding your product range, serving more clients, or operating in multiple regions, the software can easily adapt to your evolving needs.

Most GST billing software comes with features like multi-user access, cloud-based storage, and support for multiple tax rates, making it easy to manage different aspects of your business from a single platform. This scalability ensures that the software remains an asset as your business evolves.

Conclusion

In a world where time is money, GST billing software offers a powerful solution to unlock greater efficiency for your business. From simplifying tax compliance and automating invoicing to reducing errors and providing real-time insights, GST billing software can help your business thrive in a complex tax environment. By investing in this technology, you can save time, enhance productivity, and ensure accuracy in your tax filings, making it a must-have tool for modern businesses.

List of Blogs